Which of the Following Would Not Provide an Incentive to Reduce the Amount of Beef Consumed?

6. Meat

Abstract

This chapter describes contempo market place developments and highlights the medium-term projections for world meat markets for the menstruum 2021-30. Price, production, consumption and trade developments for beefiness and veal, pigmeat, poultry, and sheepmeat are discussed. The chapter concludes with a give-and-take of important risks and uncertainties that might bear on globe meat markets over the next x marketing years.

6.ane. Projection highlights

International meat prices declined in 2020 due to the impact of COVID-nineteen. Logistical hurdles and reduced food service and household spending temporarily curtailed import demand by some leading importing countries. COVID-nineteen related marketplace disturbances reduced incomes in internet meat-importing, low-income countries, significantly eroding household purchasing power and compelling consumers to substitute the intake of meat products with cheaper alternatives. The fall in international meat prices would accept been greater if the People's Republic of China (hereafter "Prc") had not sharply increased its import demand due to the African Swine Fever (ASF) outbreak, which continues to limit local production. Significantly college feed costs further hampered the profitability of the meat sector at the outset of the outlook period.

This year'south edition of the OECD-FAO Agricultural Outlook projects the global meat supply to aggrandize over the project period, reaching 374 Mt past 2030. Herd and flock expansion, especially in the Americas and China, combined with increased per animal productivity (average slaughter weight, improved breeding, and better feed formulations) will support the meat market place. China is projected to business relationship for almost of the total increase in meat production, followed past Brazil and the United States. Increase in global meat product is led mainly by growth in poultry production. The increase in pigmeat product will remain limited in the starting time three years of the Outlook due to the slow recovery from the outbreaks of ASF in China, the Philippines and Viet Nam. The recovery process is causeless to be completed past 2023, especially in China, supported by the rapid development of large scale production facilities that tin ensure biosecurity.

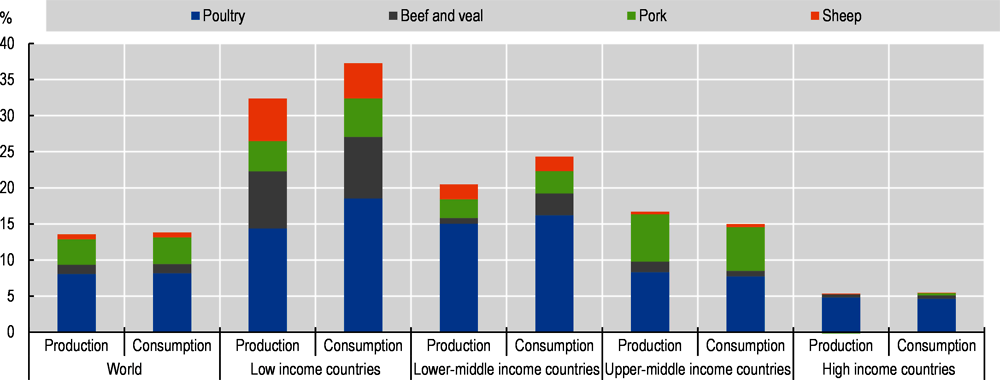

Growth in global consumption of meat proteins over the next decade is projected to increase past fourteen% past 2030 compared to the base period average of 2018-2020, driven largely past income and population growth. Protein availability from beef, pork, poultry, and sheep meat is projected to grow 5.ix%, 13.i%, 17.8% and xv.seven% respectively by 2030 (Figure 6.1). In loftier income countries, however, changes in consumer preferences, ageing, and slower growing populations volition lead to a levelling off in per capita meat consumption and a move towards the consumption of higher valued meat cuts.

Meat consumption has been shifting towards poultry. In lower income developing countries this reflects the lower price of poultry as compared to other meats, while in high-income countries this indicates an increased preference for white meats which are more convenient to prepare and perceived as a healthier food pick. Globally, poultry meat is expected to represent 41% of all the protein from meat sources in 2030, an increase of 2 percent points when compared to the base period. The global shares of other meat products are lower: beef (20%), pigmeat (34%), and sheep meat (5%). Per capita meat consumption in People's republic of china is projected to render to its longer term trend by 2023, equally the ASF bear on on domestic pigmeat prices abates. As a result, ane-tertiary of the overall increase in meat consumption over the projection menstruum is attributed to pigmeat. China will account for seventy% of the increase in pigmeat consumption from the reference period to 2030. In light of these factors, global meat consumption per capita is projected to increment 0.3% p.a. to 35.4 kg in retail weight equivalent (r.west.e.) by 2030. Over ane-half of this increment is due to college per capita consumption of poultry meat.

International meat trade will expand in response to growing demand from countries in Asia and the Well-nigh East, where product will remain largely insufficient to run into demand. Import demand in several middle and high income Asian countries has been steadily increasing in recent years due to a shift toward diets that include college quantities of animal products. International merchandise agreements have included specific provisions for meat products that improve market access and create merchandise opportunities.

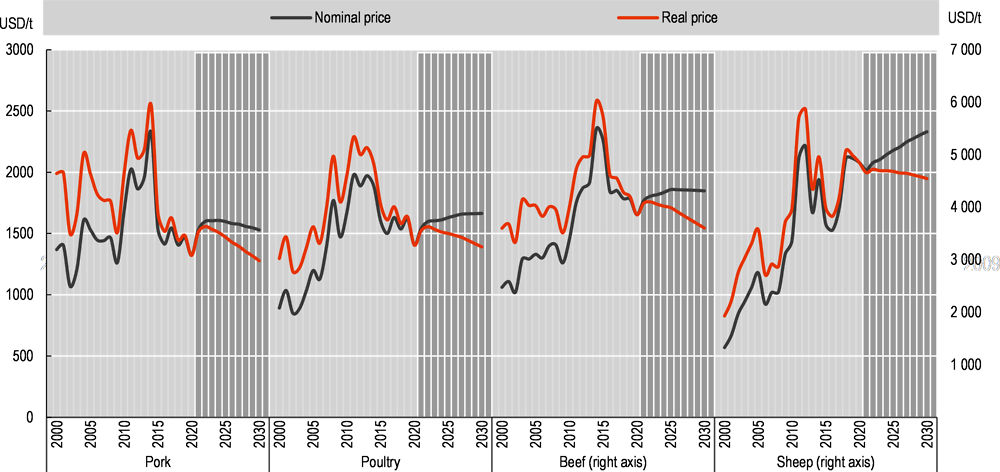

This Outlook projects that nominal meat prices for beef, pork, and poultry will recover in 2021, equally need in high income countries recovers from the COVID-19 pandemic. Further nominal cost increases are foreseen, albeit modestly, upwards to 2025 as income and consumer spending are assumed to recover in other countries, particularly in center-income countries where meat demand is responsive to income. Over the first years of the projection period, supply constraints in several Asian countries, particularly Communist china, will induce college import demand and lead to higher prices. This is specially relevant for the pigmeat sector, where ASF-related losses accept decreased product in Asia.

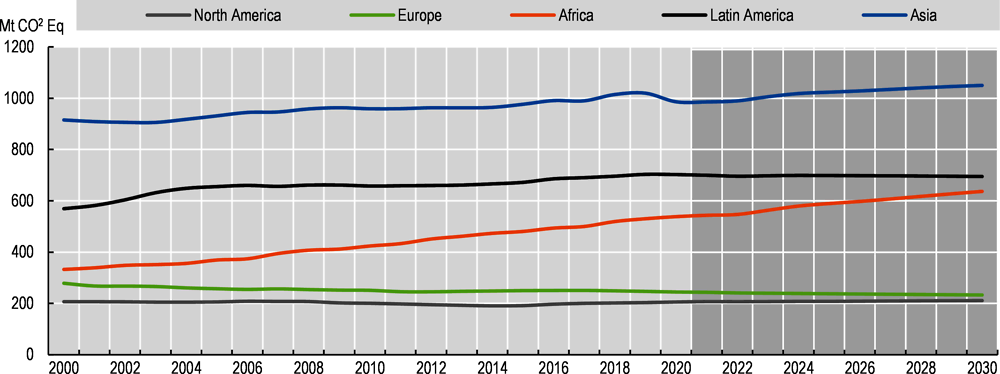

Greenhouse gas emissions (GHG) from meat product comprised about 54% of total emissions from agriculture during the 2018-20 base catamenia (in CO2 eq. footing). The increase of emissions past the meat sector of five% past 2030 is considerably less than the increase in meat production, due primarily to the increased contribution of poultry production and to projected higher meat output from a given stock of animals. The adoption of new technologies to reduce methane emissions, for example feed supplements that are not widely bachelor today, could further reduce futurity per unit emissions.

Animal disease outbreaks, sanitary restrictions, and merchandise policies volition bear on the evolution and dynamics in world meat markets. The effectiveness of global efforts to prevent and control the spread of ASF volition significantly influence the growth in the corporeality of meat traded internationally. It remains uncertain by how much global import demand will increment to satisfy the ASF-induced meat deficits in affected countries. This is expected to add volatility to meat prices in the early part of the projection period. The modalities of existing or future trade agreements (for instance, the African Continental Gratis Merchandise Expanse or the Regional Comprehensive Economic Partnership) will influence the size of trade flows and meat merchandise patterns over the outlook period, both globally and bilaterally.

The projections assume that the economic touch of the COVID-19 pandemic will exist short-lived and mainly affect the meat sector through income effects that reduce need for higher valued meat products. Some uncertainties remain on the food services sector'southward recovery path, which represents a significant role of meat consumption and, in detail, sales of expensive cuts which are not fully replaced by retail sales. These uncertainties may also affect the supply of meat and meat processing, given that health protocols and restrictions in the movement of people accept led to several meat processing facilities and slaughterers to lower their operational capacities.

The projections presume that consumer preferences will evolve following historical patterns and that income and prices will shape diets. However, other factors that could influence the meat outlook over the medium term include irresolute consumer preferences and attitudes towards lower meat poly peptide consumption at a quicker pace than has been observed in the past years. The emergence, admitting from a low base, of culling protein sources, such as cultured and plant-based substitutes for meat, and automation of the labour intensive processing, packaging (including labelling) and distribution sectors volition likewise influence projections.

half-dozen.ii. Recent market place developments

International meat prices declined in 2020 due to the impact of COVID-19, which temporarily curtailed meat demand by some leading consuming and importing countries. Logistical hurdles, reduced food service, reduced household spending due to lower incomes all contributed to this reduced demand. The fall in international meat prices would have been larger had there not been a sharp rise in meat imports by People's republic of china, where ASF continues to limit local production.

World meat production remained stable in 2020 at an estimated 328 Mt, as output increases in poultry and ovine meats offset contractions in pig and bovine meat production. Full poultry meat production in 2020 is estimated at 134 Mt, upward 1.2 % from 2019, underpinned by a sharp ascension in demand in China.

The on-going outbreak of ASF was the chief factor causing reduced pigmeat production in East asia, especially in China. Bovine meat output also brutal in some major producing countries, caused by the express availability of animals for slaughter (in Australia, New Zealand, and the European Union) and regulations associated with animal welfare, and the purchasing and transport of animals past the processing sector (India).

World meat imports in 2020 are expected to accept reached 36.three MT, growing by 6.iii% yr-on-year, led mainly by AFS-induced imports by People's republic of china; excluding China, global meat imports fell by 1.four Mt, or iv.3%. Leading exporters ‒ including Brazil, Canada, the European union, the Russian Federation (hereafter "Russia"), and the Us ‒ supplied much of the expanded import demand for meat.

half dozen.three. Prices

Meat prices are predictable to rebound from COVID-19 induced lows in 2020, and to rise moderately over the medium term as demand recovers and college feed costs are passed through; yet, they are expected to remain well beneath their peaks of ten years ago (Figure 6.2). The projected ascension in nominal meat prices is expected for all meats, although each sub-sector has unlike dynamics given their respective biological supply responses to recent shocks. However, the ratio of nominal meat prices over feed prices is projected to turn down, albeit at a slower stride compared to contempo years (Figure 6.3). The downward trend in this ratio reflects ongoing feed productivity gains within the sector, whereby less feed is required to produce a unit of meat output. Yet, college feed costs are further hampering the profitability of meat production at the start of the projection menstruum.

All meat prices are projected to autumn from the base flow levels of 2018-20, and back to longer term existent trends as costs of meat production decline in real terms. The exception is sheep meat, the prices of which take displayed an increasing tendency every bit exports from New Zealand have been constrained in view of the ascent opportunity costs of pasture land induced by rise long-term existent prices of dairy products. The reference toll for pigmeat in heavily traded Pacific markets (represented by the United states of america national base price) will increase early in the projection menstruum to see robust need, particularly from China, but will exist independent by rising export supplies from Brazil, the European union, and the U.s.a.. Poultry prices (represented by Brazil's fresh, chilled or frozen export prices) are expected to closely follow grain prices given the high share of feed costs in their production and the swift response of product to global rising demand. Beef prices (represented by US selection steer prices) are projected to increase from cyclically lower base menstruation levels, simply to remain constrained as supplies and cattle inventory levels increase in cardinal exporting countries such as Argentina, Australia, and the U.s..

6.4. Production

Global meat production is projected to expand past virtually 44 Mt past 2030, reaching 373 Mt on the ground of higher profitability, especially in the first years of the outlook menstruation as meat prices rebound postal service-COVID-19 (Figure vi.three). Overall, most meat production growth will occur in developing regions, which volition account for 84% of the additional output. The marketplace share of the Asia and Pacific regions will return to 41%, later dipping during the ASF crunch, mainly due to developments in China which is the world's largest meat producer. The product share of the world'south top 5 meat producers ‒ China, the U.s., the European union, Brazil, and Russian federation ‒ will gradually tendency downwardly from its current level, illustrating an emerging broader base for global production. Globally, depression real interest rates volition facilitate livestock expansion, and the increasing size and consolidation of production units towards a more than integrated product organisation, especially in emerging developing countries (Figure 6.4).

Poultry meat will continue to be the primary driver of meat production growth, albeit rising at a slower charge per unit in the projection menses relative to the past decade. Favourable meat-to-feed ratios compared to other ruminants, together with its brusque product bike, enables producers to answer speedily to market signals while assuasive for rapid improvements in genetics, animal health, and feeding practices. Product volition expand rapidly from sustained productivity gains in Prc, Brazil, and the U.s., and investments made in the European Matrimony (due to lower production costs in Hungary, Poland and Romania). Rapid expansion is foreseen in Asia equally the shift away from pigmeat in the short term will benefit poultry in the medium term.

Pigmeat output is projected to rise to 127 Mt past 2030, upwardly 13% from an ASF-reduced base level in 2018-20201 and benefiting from more favourable meat-to-feed ratios compared to beef meat production. The ASF outbreak across Asia, starting in late 2018, will continue to affect many countries in the early years of the outlook period, with People's republic of china, the Philippines and Viet Nam suffering the greatest impact. Information technology is projected that ASF outbreaks will go along to go on global pigmeat output below previous summit levels until 2023, after which it is expected to steadily increase over the remainder of the outlook period. This Outlook assumes that pigmeat product in China and Viet Nam will start to increase in 2021 and attain 2017 levels past 2023. Most of the pigmeat production increase in ASF-affected regions will exist the result of a shift away from backyard production facilities to commercial production facilities. Pigmeat product in the European Wedlock is projected to decrease slightly as environmental and public concerns are expected to limit its expansion. Russia, the fourth largest pigmeat producer, has almost doubled output in the last decade in response to import bans and domestic policies to restructure and stimulate production. It is projected to expand production past a farther 10% by 2030.

Beef production will grow to 75 Mt by 2030, only 5.8% higher than in the base period. Slow growth is attributable to weak beef demand as consumers shift preferences to poultry meat. Sub-Saharan Africa is projected to have the strongest growth charge per unit at 15%, due to loftier population growth. In the major producing and exporting regions, growth will be more pocket-size. In North America, the largest producing region, beef production is projected to grow 6% by 2030. Production in Europe is projected to fall 5% as inventories of dairy cows, responsible for approximately two-thirds of the beef supply, will decrease following productivity gains in the milk sector. Other factors limiting the growth potential of this sector in the Eu are a reduction in suckler cowherds due to their low profitability, escalating contest in consign markets, and declining domestic demand. In Australia, beefiness supply volition remain tight equally above boilerplate pasture production encouraged farmers to increase their livestock inventories, a significant modify from the drought conditions that have prevailed over the past few years. A gradual recovery in production is expected to follow, only herd rebuilding is expected to take several years. In India, beef production is projected to autumn by 33% by 2030 due to reforms in creature transportation and drove regulations that bear on the welfare of animals; these are assumed to remain in place for the duration of the outlook flow. Overall, beefiness producers have less ability to increase slaughter in the short term only have more flexibility to increase carcass weights, meaning that in the early on years of this Outlook beef production volition be due to higher efficiency rather than more than slaughtered animals, disallowment whatever severe droughts.

Growth in sheep meat production volition mostly originate in Asia, led by China, Pakistan, and India only significant increases in production are projected to occur in Africa, particularly in the least developed countries of Sub-Saharan Africa. Despite limitations linked to urbanisation, desertification, and the availability of feed in some countries, sheep and goats are well adapted to the region and the extensive production systems it utilises. In Oceania, product growth is expected to increment moderately considering of ongoing competition for pastureland from beef and dairy in New Zealand, which is the major exporter, equally well as the extreme and prolonged drought in Australia where total sheep numbers barbarous from 72 to 63 one thousand thousand from 2017 to 2020. Sheep meat production in the European Union is expected to remain stable as it volition exist sustained by the voluntary coupled support in the chief sheep-producing Fellow member States.

The projections presume that situations due to COVID-xix and animal diseases (ASF and Highly Pathogenic Avian Influenza ‒ HPAI) volition normalise in the short term, and that no further critical shocks will hitting feed grain markets. Every bit a result, meat supply will ascension in response to increasing demand over the medium term with further intensification of product and efficiency gains. If the situation evolves differently, these projections will need to be revised accordingly.

6.4.1. Greenhouse gas emissions volition increase slowly

Information technology is estimated that humans and the animals raised for food constitute 96% of all mammals on earth, and that poultry represents 70% of all alive birds.2 It is projected that stocks of farmed animals for meat will increase during the next decade, rising xi%, 9%, two% and 18% for poultry, pigs, beef cattle and sheep respectively. These projections imply college output-to-animal inventory ratios, which while slowing compared to the previous decade, stand for continued increases in the productivity of fauna stocks over the menstruum, past 6%, three%, iv% and a two% respectively. These changes in herd inventories and productivity increases are reflected in the meat sector emissions, which are projected to rise by 5% by 2030. This growth is considerably less than the ascent in meat production due primarily to shifts towards poultry production, national low carbon emission initiatives, and increased productivity which yields higher meat output from a given stock of animals. New technologies that reduce marsh gas emissions which are not widely available at present, such every bit feed supplements and seaweed, could further reduce hereafter per unit emissions. The strongest growth in meat-related greenhouse gas emissions will exist in Africa (Effigy half dozen.5). A renewed effort to reduce GHG emissions could include policies such as carbon taxes and specific regulations combined with incentives to prefer technologies and production systems that reduce the sector's GHG footprint.

6.5. Consumption

Determinants of meat consumption are complex. Demographics, urbanisation, incomes, prices, tradition, religious behavior, cultural norms, and environmental, ethical/animal welfare and health concerns are fundamental factors that affect non only the level just likewise the type of meat consumption. The by several decades take witnessed considerable changes in the impact of each of these factors beyond a broad array of countries and regions. Population growth is clearly the chief driver of increased consumption, and the projected global increase of eleven% volition underpin a projected increase of fourteen% in global meat consumption past 2030, compared to the base period of this Outlook (Figure 6.6). It is the chief reason why meat consumption is projected to grow by 30% in Africa, 18% in the Asia and Pacific region, and 12% in the Latin American region; the projected increment in meat consumption is 0.four% in Europe and nine% in North America.

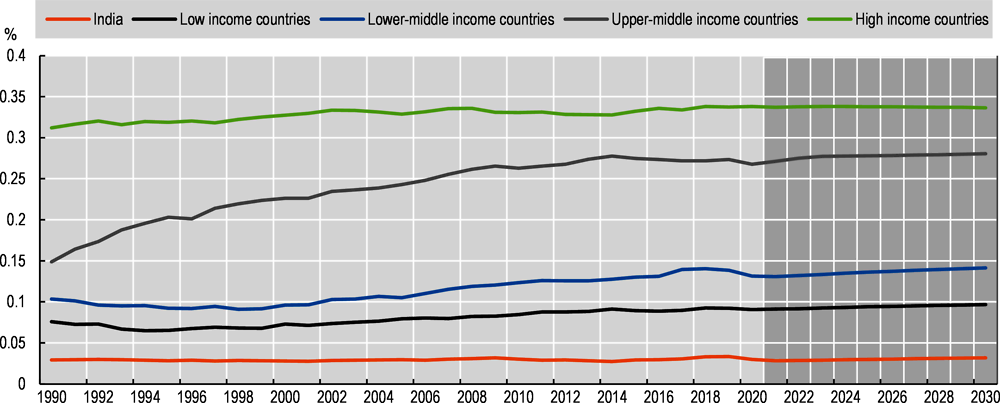

Economic growth is another of import commuter of meat consumption. Income growth enables the purchase of meat, which is typically a more expensive source of calories and proteins. It is also accompanied by other structural changes such as greater urbanisation, college labour participation, and food service expenditures that encourage higher meat purchases. The response of per capita meat consumption to income increases is demonstrably college at lower incomes, and less so at college incomes where consumption is largely saturated and limited by other factors such as environmental, and ethical/animal welfare and health concerns.

Empirical evidence on consumer behaviour suggests that increases in income stimulate a college consumption of loftier value foods such as animal poly peptide compared to other foods such as carbohydrates. In full general, the testify since 1990 suggests that such a shift has been marginal (Figure half-dozen.vii). The shares of meat proteins in total protein availability has increased somewhat for upper middle-income countries, but recently less then or not at all for lower middle-income and low-income countries when income increases take not been high enough to stimulate a dietary shift, or in high-income countries where diets remained unchanged. These trends are not anticipated to change much over the next decade. Indeed, it is possible that higher incomes in lower middle-income and depression-income countries in item may induce college per capita food consumption, but not necessarily a higher share of meats in diets.

A clear trend is the rising of poultry meat consumption in nigh all countries and regions (Figure 6.7). Consumers are attracted to poultry due to lower prices, production consistency and adaptability, and higher protein/lower fat content. Consumption of poultry meat is projected to increment globally to 152 Mt over the projection period, accounting for 52% of the boosted meat consumed. On a per capita basis, the expected robust growth rates in poultry consumption reverberate the meaning role it plays in the national diets of several populous developing countries, including Prc and India.

Global pigmeat consumption is projected to increase to 127 Mt over the adjacent 10 years and to account for 33% of the total increase in meat consumption. On a per capita ground, pigmeat consumption is expected to marginally increase over the outlook period while its consumption declines in almost developed countries. In the European Union, for example, it is projected to reject as changes in the limerick of the population influence diets that volition favour poultry to pigmeat; the onetime is not only cheaper, merely perceived as a healthier food choice. In developing countries, per capita consumption of pigmeat, which is half that in adult countries, is expected to marginally increase over the projection period. Growth rates are sustained in most of Latin America, where per capita pigmeat consumption has grown speedily, backed by favourable relative prices that take positioned pork as one of the favoured meats, along with poultry to meet ascension demand from the eye course. Several Asian countries, which traditionally swallow pork, are projected to increment consumption on a per capita footing one time the bear on of ASF wanes.

Global per capita beef consumption, which has declined since 2007, is projected to fall by a further 5% by 2030. Asia and the Pacific is the simply region where per capita beef consumption is projected to increase over the outlook menstruation, albeit from a low base. In China, the world's second largest consumer of beef in absolute terms, per capita consumption is projected to ascension a farther 8% by 2030, after having risen 35% in the last decade. But virtually countries that have high beef per capita consumption volition see their level of beef consumption decline in favour of poultry meat. For instance, in the Americas, which is where preferences for beef are among the highest in the world, per capita consumption will fall in Argentina (-7%), Brazil (-half-dozen%), the U.s.a. (-1%), and Canada (-7%). It is also expected to fall significantly in Australia and New Zealand.

Global sheep meat consumption, a niche market place in some countries and considered a premium component of diets in many others, is projected to increment to eighteen Mt over the outlook period and to business relationship for half dozen% of the boosted meat consumed. Sheep meat consumption worldwide, on a per capita ground, is comparable in both developing and developed countries. In many Near Eastern and North African (NENA) countries, where sheep meat is traditionally consumed, per capita consumption is projected to continue its long-term decline as that for poultry increases. Demand growth in this region is linked to the oil market, which essentially influences the disposable income of the middle class and government spending patterns.

half dozen.vi. Trade

Global meat exports are projected to be 8% college past 2030 than in the base menses, reaching xl Mt. This may appear to be a considerable tiresome-down in the growth of meat trade compared to the previous decade, but is largely the consequence of loftier pigmeat trade during the ASF crisis in Asia, specially in People's republic of china. By 2030, the proportion of meat output traded will be stable at effectually 11%.

Rise imports over the next decade volition exist comprised mainly of poultry, the largest correspondent, and beef. Together, these ii meat types are projected to account for about of the additional meat imports into Asia and Africa where consumption growth will outpace the expansion of domestic production.

Meat exports are concentrated, and the combined share of the iii largest meat exporting countries – Brazil, the European Marriage, and the United States – is projected to remain stable and account for around lx% of global world meat exports over the outlook flow. In Latin America, traditional exporting countries are expected to retain a high share of the global meat trade, benefiting from the depreciation of their currencies and surplus feed grain production. Brazil, which is the largest exporter of poultry meat, will go the largest beef exporter with a 22% market place share. India's exports of beef volition plummet past 53% to 0.vi Mt by 2030, given the government reforms concerning brute welfare that are assumed to remain in identify over the outlook period; exports vicious by fourteen% in 2020, and are expected to autumn a further 26% in 2021 (Figure 6.ix). Meat trade in value is dominated by beef and veal, but increasingly dominated by poultry in quantity

Import demand is expected to increase the fastest in terms of volume in Africa, 1.4 Mt or 48% from the base period. The Asian region will account for 52% of global trade by 2030. The greatest increases in imports will occur in the Philippines and Viet Nam, the latter for poultry meat. While Chinese meat imports remain high in the early part of the projection period, a gradual decline is projected in the second half of the projection period as pigmeat production recovers from the ASF outbreak. The increased import demand for pigmeat in Communist china is expected to yield high benefits for Brazil, Canada, the European Union, and the United States. In Russian federation, the long-term effects of the routinely extended 2014 import ban on meat, which this Outlook assumes volition exist prolonged until the cease of 2021, has stimulated domestic production, and meat import levels are expected to continue to decline over the projection period.

Sheep meat exports from Australia and New Zealand have benefitted from the weak NZD and AUD relative to the The states dollar, as well every bit from strong global need. Shipments to China are projected to remain high every bit meaning growth in Chinese demand for sheep meat is expected for the duration of the ASF outbreak. This contrasts with decreased demand from the United Kingdom and continental Europe in the start half of the outlook menses. Imports past the Near East and Due north Africa region are projected to increase. As a result, Commonwealth of australia is expected to go on to increase its lamb production at the expense of mutton. In New Zealand, consign growth is projected to be marginal equally land use has shifted from sheep farming to dairy.

vi.vii. Chief issues and uncertainties

Several assumptions drive the results of the analysis of the medium to longer term outlook for meat markets. The first concerns the impact of diseases ‒ human and animal ‒ on meat markets. COVID-19 clearly affected meat markets in 2020 and will accept implications for the medium term as the subtract in consumer demand is expected to put downwardly pressure on agricultural prices and product.iii This Outlook assumes that the impacts of COVID-xix on economic growth and on restrictions in the motion of people and goods volition be short-lived and that recovery will starting time in 2021. Nonetheless, whatsoever prolongation of the pandemic and slower economic recovery may affect supply in terms of logistical issues in processing, transport, and trade. At the same time, the impact of the pandemic on meat demand equally countries recover will be important in and so far as the extent to which information technology has affected the restaurant/hotel and tourism sectors.

Animal diseases such every bit ASF, highly pathogenic avian influenza (HPAI), foot and oral cavity disease (FMD) always pose significant risks for meat markets. Outbreaks can occur quickly and shock markets, which may accept years to recover. This Outlook assumes that recovery from ASF in E Asia volition exist completed by the end of the projection flow, just at that place is risk that this is not the instance or that ASF emerges elsewhere.iv Investments to restructure and modernise product and processing facilities in the pigmeat sector, the successful evolution of a vaccine, every bit well as the implementation of recently developed compartmentalisation guidelines from the World Organisation for Animal Health (OIE),5 may have implications for future production and merchandise. It should exist noted that Russia'due south investments in its pigmeat sector enabled information technology to nearly double its output over the terminal decade.

This Outlook has long held that existing markets for beef and pigmeat are segmented, i.e. into "Pacific" and "Atlantic" markets. Recent bear witness suggests this segmentation is less evident as markets have become increasingly integrated over time. For instance, price correlations between the two markets take increased in the last decade. The segmentation of markets was originally acquired past the partition of countries between those complimentary of FMD and those which were not; as such, trade was partitioned appropriately and countries affected by FMD could non merchandise with countries gratis of FMD. However, once the World Organization for Animate being Health (OIE) was able to facilitate the zoning of FMD-free areas inside countries without resorting to vaccinations, the trade adventure of an FMD outbreak was minimised. This allowed other zones of an FMD-afflicted country to increase trade in response to marketplace signals (international prices) with countries gratis of FMD6. In time, countries such as Brazil, which was initially pivotal in the "Atlantic" market, were able to develop markets in the "Pacific" zone.

Assumptions regarding productivity improvements and climatic change policies volition affect Outlook analysis of the meat sectors contribution to climatic change. As meat is a significant user of resources ‒ of land, feed and water ‒ lower demand along with productivity improvements imply lower demand for these resources. For example, lower demand and higher productivity for beef implies lower fauna inventories and hence fewer feed inputs (meat production in 2018-20 uses around 37% of the calories produced by the crops covered in this Outlook). vii Lower production would also imply lower GHG emissions from meat production compared to past decades. The role of the meat sector is critical in discussions on climate change, and hereafter policies may have of import consequences for production and merchandise.

Finally, this Outlook assumes that consumer preferences will evolve according to historical patterns. As a outcome, dietary preferences for lower meat consumption (due east.g. vegetarian or vegan diets) or for alternative protein sources (e.yard. cultured and plan-based protein substitute for meat) are assumed to aggrandize slowly and to be adopted by a small role of population concentrated mainly in high income countries, and therefore hardly impact meat consumption over the adjacent decade. Nevertheless, while the competition from substitutes will increment, consumer choice will continue to be influenced by the nutritional content in meat as compared to protein substitutes.

Consumers are too expressing concerns about meat production systems, including traceability and the use of antimicrobials in feeds. While the technical benefits of antimicrobial use in fauna production are well documented, there is a growing preference for antimicrobial-gratis meat due to the global risks associated with antimicrobial resistance.8 If antimicrobial-gratis meat production systems are adopted past an increasing share of producers, this may touch global meat markets, albeit in the longer term. The extent to which consumers are willing to pay a premium for such meat remains unclear.

Nevertheless, as consumer preferences for such diets increment more apace than in past years, meat demand may contract, reducing in plow meat production and import demand.

Notes

← one. Unless otherwise specified, % changes refer to the change from the average base period 2018/twenty and 2030.

← two. Dasgupta, P. (2021), The Economics of Biodiversity: The Dasgupta Review, Abridged Version, HM Treasury, London, p.1.

← 3. OECD (2020), "The impact of COVID-19 on agricultural markets and GHG emissions",OECD Policy Responses to Coronavirus (COVID-nineteen), OECD Publishing, Paris, https://doi.org/x.1787/57e5eb53-en.

← 4. Frezal, C., S. Gay and C. Nenert (2021), "The Impact of the African Swine Fever outbreak in China on global agricultural markets", OECD Food, Agriculture and Fisheries Papers, No. 156, OECD Publishing, Paris, https://doi.org/10.1787/96d0410d-en.

← 5. OIE (2020), Compartmentalization Guidelines: African Swine Fever, Paris.

← 6. Holst, Carsten and von Cramon-Taubadel (2012), "International Synchronisation of the Pork Wheel," Acta Oeconomica et Informatica, Faculty of Economics and Management, Slovak Agricultural University in Nitra (FEM SPU), Vol. 15(1), pp. 1-six, March.

← vii. For more analysis see OECD/FAO (2020),OECD-FAO Agricultural Outlook 2020-2029, OECD Publishing, Paris/FAO, Paris, https://doi.org/10.1787/1112c23b-en.

← eight. Ryan, M. (2019), "Evaluating the economic benefits and costs of antimicrobial utilise in food-producing animals",OECD Food, Agriculture and Fisheries Papers, No. 132, OECD Publishing, Paris, https://doi.org/10.1787/f859f644-en.

Source: https://www.oecd-ilibrary.org/sites/cf68bf79-en/index.html?itemId=%2Fcontent%2Fcomponent%2Fcf68bf79-en

0 Response to "Which of the Following Would Not Provide an Incentive to Reduce the Amount of Beef Consumed?"

Post a Comment